The Gold Standard should have remained the standard

- Thread starter Nehemiah6

- Start date

-

Christian Chat is a moderated online Christian community allowing Christians around the world to fellowship with each other in real time chat via webcam, voice, and text, with the Christian Chat app. You can also start or participate in a Bible-based discussion here in the Christian Chat Forums, where members can also share with each other their own videos, pictures, or favorite Christian music.

If you are a Christian and need encouragement and fellowship, we're here for you! If you are not a Christian but interested in knowing more about Jesus our Lord, you're also welcome! Want to know what the Bible says, and how you can apply it to your life? Join us!

To make new Christian friends now around the world, click here to join Christian Chat.

Any physical thing can be "sound money". It simply depends upon agreement between two parties as to the value of the thing relative to other things that are desired by either of them.

I think you are streeeeeching it there Dino246.

And it is more that just an agreement there are other considerations as to what constitutes sound money.

Here is an article by a knowledgeable person telling us how foolish it was to resort to paper currency. Even as long ago as 1786 George Washington was fully aware of this folly.

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

https://www.infowars.com/posts/fixi...er-from-gold-standard-to-fiat-folly-and-back/

So was this FDR's blunder or something else, since he would have known what Washington said.

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

https://www.infowars.com/posts/fixi...er-from-gold-standard-to-fiat-folly-and-back/

So was this FDR's blunder or something else, since he would have known what Washington said.

I am just looking for your thoughts.

Something else known as the Nixon Shock where the Republicans did away with the gold standard(shhh don't tell anyone,,lol) https://en.wikipedia.org/wiki/Nixon_shock

these things don't occur in a vacuum. it looks to me like at least part of the purpose was an illegally large federal gov't.

I once heard a Native American Indian Chief say that they viewed seeds as their wealth for barter and not gold.

Makes total sense in an agrarian world.

I tell you I have tomato seeds and seeds for Italian string beans( nowhere to be found in grocery stores) I plant they are pretty much like gold to me, well not really I do like my bling. lol

Gold has outperformed just about every other possible investment that was available when the US went off the gold standard. If Social Security had put all of its investments into buying gold then no doubt gold would be much, much higher today than it was back in the 70s and everyone's social security would be well funded.

Good explanation from this article on why we value gold:

This article will address all of these questions and more. Let’s begin by examining why gold became the most sought after metal in human history.

Why Gold and Not Something Else?

Unlike the many other metals found around the globe, gold has held and retained a high status because of three specific properties: scarcity, durability, and malleability, which I will discuss each in turn.

Scarcity

Gold wouldn’t be what it is if it were as readily available as aluminum, the most abundant metal in Earth’s crust. However, it also wouldn’t be gold if it was as uncommon as rhodium, a rare Earth metal with one-tenth of gold’s annual production. As Warren Buffett stated in his 2011 letter to shareholders:

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.)

And that gold pile only grows a few thousand metric tons per year, or by 2% of the current global gold stock.

This relationship between gold’s stock and its flow makes it the metaphoric “goldilocks” of Earthly metals— rare enough to be prized, but common enough to be found and utilized throughout the world. Without this relative scarcity, gold might have been just another glittering rock.

Durability

However, scarcity alone isn’t enough to give gold its high status. Gold also has the unique property of being one of the most durable metals on the planet. It doesn’t rust. It doesn’t tarnish. And it can only be corroded under very specific circumstances.

You can bury your gold and come back in 50 years (or 50,000 years) and it would be basically unchanged. This is why Peter Bernstein wrote in The Power of Gold:

In a world where everything we know degrades, this is why gold is literally able to stand the test of time.

Malleability

Even with its scarcity and durability, gold would have had a much harder time becoming a global phenomenon if not for its unsurpassed malleability. In fact, gold is the most malleable of all metals. It’s so flexible that one ounce can be made into a thin continuous sheet measuring roughly 100 square feet or stretched into a wire over 50 miles long. Pure gold is incredibly soft (for a metal), which allows it to be reshaped with relative ease.

Think about how useful of a quality this is for a store of value. You can divide it, hide it, or transport it from place to place with very little effort. What more could you ask for in a material?

When combined with gold’s scarcity and virtual indestructibility, it’s no wonder that people chased it the world over for centuries. Outside of nailing the trifecta of scarcity, durability, and malleability, gold’s true value comes from embodying the concept of proof of work.

Continued….

This article will address all of these questions and more. Let’s begin by examining why gold became the most sought after metal in human history.

Why Gold and Not Something Else?

Unlike the many other metals found around the globe, gold has held and retained a high status because of three specific properties: scarcity, durability, and malleability, which I will discuss each in turn.

Scarcity

Gold wouldn’t be what it is if it were as readily available as aluminum, the most abundant metal in Earth’s crust. However, it also wouldn’t be gold if it was as uncommon as rhodium, a rare Earth metal with one-tenth of gold’s annual production. As Warren Buffett stated in his 2011 letter to shareholders:

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.)

And that gold pile only grows a few thousand metric tons per year, or by 2% of the current global gold stock.

This relationship between gold’s stock and its flow makes it the metaphoric “goldilocks” of Earthly metals— rare enough to be prized, but common enough to be found and utilized throughout the world. Without this relative scarcity, gold might have been just another glittering rock.

Durability

However, scarcity alone isn’t enough to give gold its high status. Gold also has the unique property of being one of the most durable metals on the planet. It doesn’t rust. It doesn’t tarnish. And it can only be corroded under very specific circumstances.

You can bury your gold and come back in 50 years (or 50,000 years) and it would be basically unchanged. This is why Peter Bernstein wrote in The Power of Gold:

In Cairo, you will find a tooth bridge made of gold for an Egyptian 4,500 years ago, its condition good enough to go into your mouth today.

The immense durability of gold makes it one of the few things in nature that can act as a true store of value. This is why gold has been used as a currency throughout history—it doesn’t break down through daily use.In a world where everything we know degrades, this is why gold is literally able to stand the test of time.

Malleability

Even with its scarcity and durability, gold would have had a much harder time becoming a global phenomenon if not for its unsurpassed malleability. In fact, gold is the most malleable of all metals. It’s so flexible that one ounce can be made into a thin continuous sheet measuring roughly 100 square feet or stretched into a wire over 50 miles long. Pure gold is incredibly soft (for a metal), which allows it to be reshaped with relative ease.

Think about how useful of a quality this is for a store of value. You can divide it, hide it, or transport it from place to place with very little effort. What more could you ask for in a material?

When combined with gold’s scarcity and virtual indestructibility, it’s no wonder that people chased it the world over for centuries. Outside of nailing the trifecta of scarcity, durability, and malleability, gold’s true value comes from embodying the concept of proof of work.

Continued….

Do you think the economy could have expanded the way it did over the years if the USA had held to the gold standard?

I am just looking for your thoughts.

I am just looking for your thoughts.

Where the money multiplier effect would still happen (as Daniel the prophet did for Babylon by creating the central banking system we use today) our currency would be vulnerable to the "supply &demand" laws that affect stock prices today and can be manipulated easily.

When cash becomes scarce people resort to other commodities for the exchange of goods. And deflation is a constant concern. (Where the commodity you hold loses its store of value)

-

1

- Show all

Why Gold is Valuable (Proof of Work)

Despite the beneficial chemical properties of gold highlighted above, its real value comes from the difficulty of its acquisition. As Joe Weisenthal stated in a speech from May 2018:

While you don’t need the ability to “run a state-like entity” today to acquire gold, the idea still holds. What made gold valuable historically (and what makes it valuable today) is not its explicit ownership (i.e. I have a rare, shiny piece of metal), but the implicit message of that ownership (i.e. I have the skills/ability/resources to acquire a rare, shiny piece of metal).

The best example I can provide to illustrate this is the history of aluminum. When aluminum was first discovered in the late 1700s, it was initially more valuable than gold because of how difficult it was to obtain. In fact, aluminum was used to cap the Washington Monument, when it was first completed in 1880.

However, as the refining process improved and aluminum extraction became easier, the once rare metal became much less rare. The increased availability of aluminum decreased its proof of work and, thus, reduced its value relative to gold. What started as the capstone to one of America’s most treasured landmarks eventually became the go-to container for sugar water.

This is the undeniable strength of proof of work. With it, you are admired and, without it, you are ignored. So goes the story of gold.

Now that we have discussed why gold is valuable to society, let’s examine how gold might be valuable to you.

When Gold Became an Investment

For most of modern history gold was used as a currency in some form or fashion. This is why William Bernstein remarked that:

Because gold literally was money, there was no inherent gains to be made from owning it.

However, this all changed after the United States abandoned the gold standard in 1973 and allowed American citizens to, once again, privately own gold in August 1974.

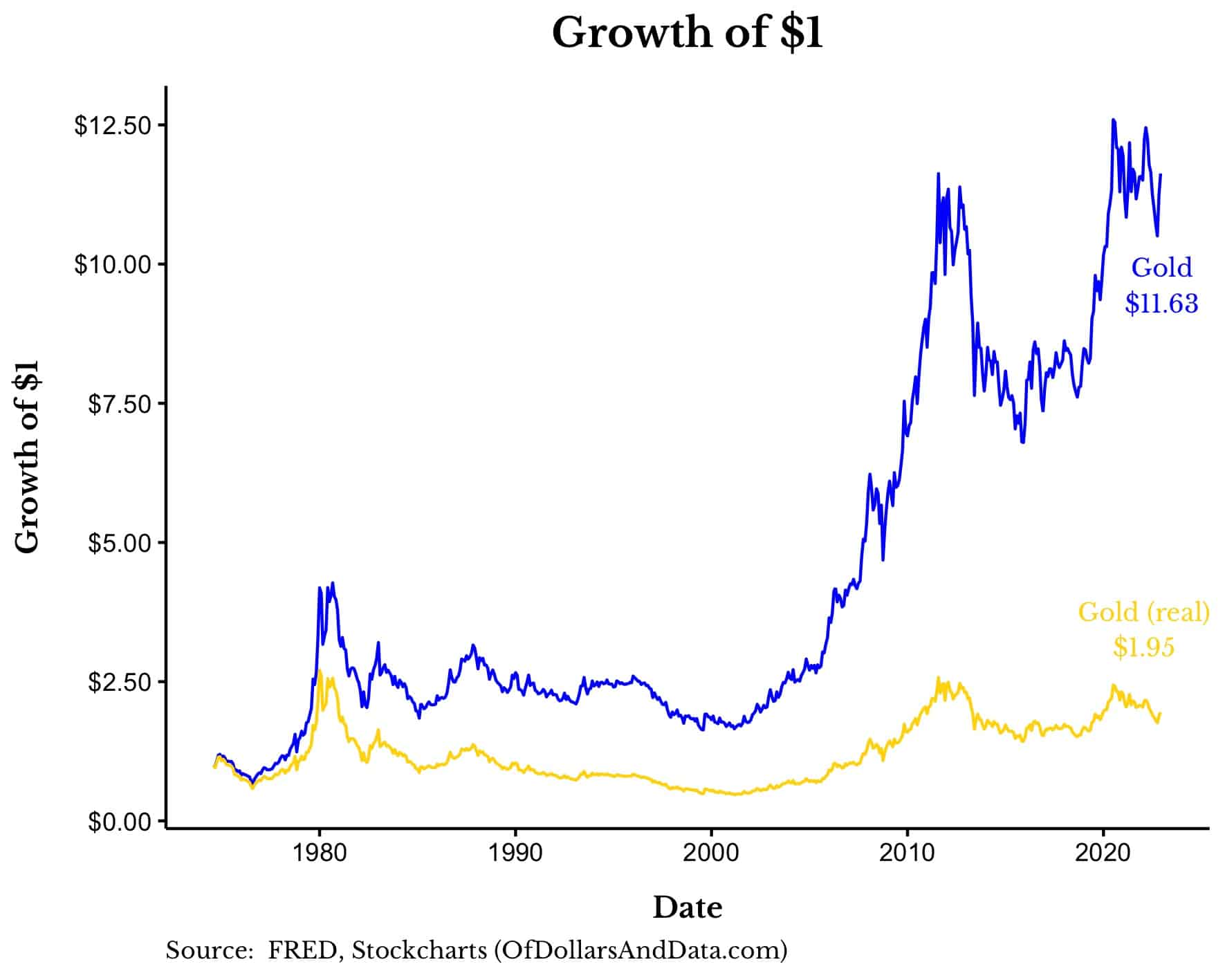

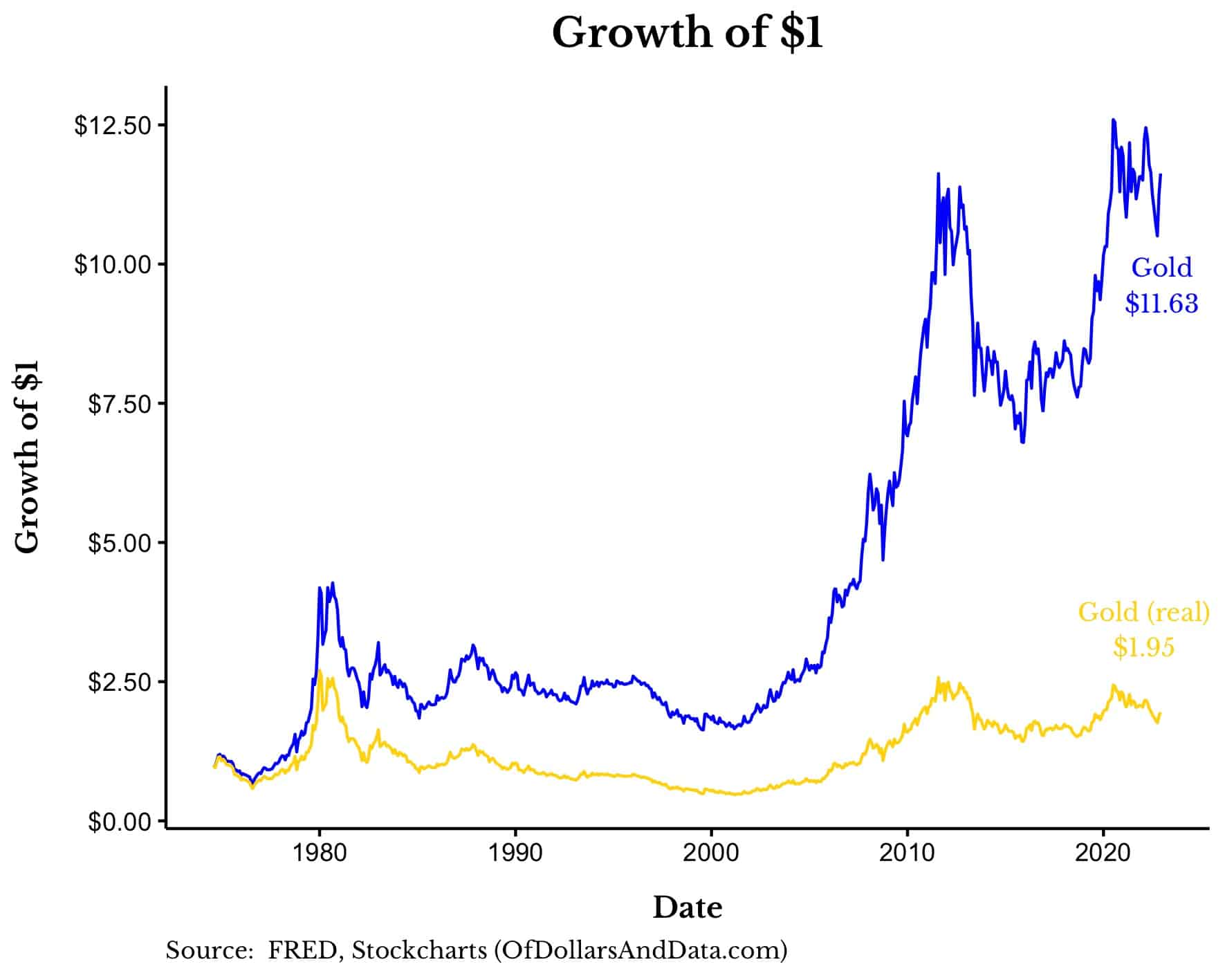

Since then, gold has increased in value from $156 an ounce to around $1,930 today (January 2023). Adjusting for inflation, gold has doubled its purchasing power since it was decoupled from the U.S. dollar:

Despite the beneficial chemical properties of gold highlighted above, its real value comes from the difficulty of its acquisition. As Joe Weisenthal stated in a speech from May 2018:

One of the striking things about gold is just how incredibly hard it is to attain (and hold onto once

you have it) and the different things you have to master to get gold.

To get gold you

— Have to be good at warfare

— Be able to marshall an extensive human workforce to mine it

— Mastery of global supply and logistics routes

— Be able to command guards who will watch your gold, and not steal it

— Have the technical know-how to get gold out of the ground, which is expensive and

cumbersome. And so on…

In other words, when you have gold you’re communicating all the different things you’re capable

of (mastering supply routes, commanding an army, scientific endeavor, marshalling labor, etc.)

Gold, then, is a very specific proof of work. If you can get gold, you’ve proven that you have the

ability to run a state or some state-like entity.

you have it) and the different things you have to master to get gold.

To get gold you

— Have to be good at warfare

— Be able to marshall an extensive human workforce to mine it

— Mastery of global supply and logistics routes

— Be able to command guards who will watch your gold, and not steal it

— Have the technical know-how to get gold out of the ground, which is expensive and

cumbersome. And so on…

In other words, when you have gold you’re communicating all the different things you’re capable

of (mastering supply routes, commanding an army, scientific endeavor, marshalling labor, etc.)

Gold, then, is a very specific proof of work. If you can get gold, you’ve proven that you have the

ability to run a state or some state-like entity.

While you don’t need the ability to “run a state-like entity” today to acquire gold, the idea still holds. What made gold valuable historically (and what makes it valuable today) is not its explicit ownership (i.e. I have a rare, shiny piece of metal), but the implicit message of that ownership (i.e. I have the skills/ability/resources to acquire a rare, shiny piece of metal).

The best example I can provide to illustrate this is the history of aluminum. When aluminum was first discovered in the late 1700s, it was initially more valuable than gold because of how difficult it was to obtain. In fact, aluminum was used to cap the Washington Monument, when it was first completed in 1880.

However, as the refining process improved and aluminum extraction became easier, the once rare metal became much less rare. The increased availability of aluminum decreased its proof of work and, thus, reduced its value relative to gold. What started as the capstone to one of America’s most treasured landmarks eventually became the go-to container for sugar water.

This is the undeniable strength of proof of work. With it, you are admired and, without it, you are ignored. So goes the story of gold.

Now that we have discussed why gold is valuable to society, let’s examine how gold might be valuable to you.

When Gold Became an Investment

For most of modern history gold was used as a currency in some form or fashion. This is why William Bernstein remarked that:

Because gold literally was money, there was no inherent gains to be made from owning it.

However, this all changed after the United States abandoned the gold standard in 1973 and allowed American citizens to, once again, privately own gold in August 1974.

Since then, gold has increased in value from $156 an ounce to around $1,930 today (January 2023). Adjusting for inflation, gold has doubled its purchasing power since it was decoupled from the U.S. dollar:

-

1

- Show all

Well I did state "stability" not stable which implies a sense of fluctuation. And stable and intrinsic are two concepts and stable/stability is an appropriate term to be used in the discussion of economics.

Not really sure of this point, surely none of these past practices have any application to our complex modern economies, except for the gold standard but I can also agree that not having a gold standard as a position also has some weight in monetary policy.

Yes, it has value because of aesthetics but I thought were speaking about the gold standard. So let's stay focused.

The Gold Standard was a system under which nearly all countries fixed the value of their currencies in terms of a specified amount of gold, or linked their currency to that of a country which did so. Domestic currencies were freely convertible into gold at the fixed price and there was no restriction on the import or export of gold. Gold coins circulated as domestic currency alongside coins of other metals and notes, with the composition varying by country. As each currency was fixed in terms of gold, exchange rates between participating currencies were also fixed.

Central banks had two overriding monetary policy functions under the classical Gold Standard:

- Maintaining convertibility of fiat currency into gold at the fixed price and defending the exchange rate.

- Speeding up the adjustment process to a balance of payments imbalance, although this was often violated.

In 1871, the newly unified Germany, benefiting from reparations paid by France following the Franco-Prussian war of 1870, took steps which essentially put it on a Gold Standard. The impact of Germany’s decision, coupled with the then economic and political dominance of the UK and the attraction of accessing London’s financial markets, was sufficient to encourage other countries to turn to gold. However, this transition to a pure Gold Standard, in some opinions, was more based on changes in the relative supply of silver and gold. Regardless, by 1900 all countries apart from China, and some Central American countries, were on a Gold Standard. This lasted until it was disrupted by the First World War. Periodic attempts to return to a pure classical Gold Standard were made during the inter-war period, but none survived past the 1930s Great Depression.

How the Gold Standard Worked

Under the Gold Standard, a country’s money supply was linked to gold. The necessity of being able to convert fiat money into gold on demand strictly limited the amount of fiat money in circulation to a multiple of the central banks’ gold reserves. Most countries had legal minimum ratios of gold to notes/currency issued or other similar limits. International balance of payments differences were settled in gold. Countries with a balance of payments surplus would receive gold inflows, while countries in deficit would experience an outflow of gold.

In theory, international settlement in gold meant that the international monetary system based on the Gold Standard was self-correcting. Namely, a country running a balance of payments deficit would experience an outflow of gold, a reduction in money supply, a decline in the domestic price level, a rise in competitiveness and, therefore, a correction in the balance of payments deficit. The reverse would be true for countries with a balance of payments surplus. This was the so called ‘price-specie flow mechanism’ set out by 18th century philosopher and economist David Hume.

This was the underlying principle of how the Gold Standard operated, although in practice it was more complex. The adjustment process could be accelerated by central bank operations. The main tool was the discount rate (the rate at which the central bank would lend money to commercial banks or financial institutions) which would in turn influence market interest rates. A rise in interest rates would speed up the adjustment process through two channels. First, it would make borrowing more expensive, reducing investment spending and domestic demand, which in turn would put downward pressure on domestic prices, enhancing competitiveness and stimulating exports. Second, higher interest rates would attract money from abroad, improving the capital account of the balance of payments. A fall in interest rates would have the opposite effect. The central bank could also directly affect the amount of money in circulation by buying or selling domestic assets though this required deep financial markets and so was only done to a significant extent in the UK and, latterly, in Germany.

The use of such methods meant that any correction of an economic imbalance would be accelerated and normally it would not be necessary to wait for the point at which substantial quantities of gold needed to be transported from one country to another.

The ‘Rules of the Game’

The ‘rules of the game’ is a phrase attributed to Keynes (who in fact first used it in the 1920s). While the ‘rules’ were not explicitly set out, governments and central banks were implicitly expected to behave in a certain manner during the period of the classical Gold Standard. In addition to setting and maintaining a fixed gold price, freely exchanging gold with other domestic money and permitting free gold imports and exports, central banks were also expected to take steps to facilitate and accelerate the operation of the standard, as described above. It was accepted that the Gold Standard could be temporarily suspended in times of crisis, such as war, but it also was expected that it would be restored again at the same parity as soon as possible afterwards.

In practice, a number of researchers have subsequently shown[1] that central banks did not always follow the ‘rules of the game’ and that gold flows were sometimes ‘sterilised’ by offsetting their impact on domestic money supply by buying or selling domestic assets. Central banks could also affect gold flows by influencing the ‘gold points’. The gold points were the difference between the price at which gold could be purchased from a local mint or central bank and the cost of exporting it. They largely reflected the costs of financing, insuring and transporting the gold overseas. If the cost of exporting gold was lower than the exchange rate (i.e. the price that gold could be sold abroad) then it was profitable to export gold and vice versa.

A central bank could manipulate the gold points, using so-called ‘gold devices’ in order to increase or decrease the profitability of exporting gold and therefore the flow of gold. For example, a bank wishing to slow an outflow of gold could raise the cost of financing for gold exporters, increase the price at which it sold gold, refuse to sell gold completely or change the location where the gold could be picked up in order to increase transportation costs.

Nevertheless, provided such violations of the ‘rules’ were limited, provided deviations from the official parity were minor and, above all, provided any suspension was for a clear purpose and strictly temporary, the credibility of the system was not put in doubt. Bordo[2] argues that the Gold Standard was above all a ‘commitment’ system which effectively ensured that policy makers were kept honest and maintained a commitment to price stability.

One further factor which helped the maintenance of the standard was a degree of cooperation between central banks. For example, the Bank of England (during the Barings crisis of 1890 and again in 1906-7), the US Treasury (1893), and the German Reichsbank (1898) all received assistance from other central banks.

[1]Bloomfield, A., Monetary Policy Under the Gold Standard, 1880 to 1914, Federal Reserve Bank of New York, (1959); Dutton J., The Bank of England and the Rules of the Game under the International Gold Standard: New Evidence, in Bordo M. and Schwartz A., Eds, A Retrospective on the Classical Gold Standard, NBER, (1984)

[2]Bordo, M., Gold as a Commitment Mechanism: Past. Present and Future, World Gold Council Research Study no. 11, December 1995

https://www.gold.org/history-gold/the-classical-gold-standard

-

1

-

1

- Show all

You do realize that "stable" and "stability" are simply different forms of the same root word?

The point is that for anything to be used as currency, there must be agreement as to its relative value.

The point is that for anything to be used as currency, there must be agreement as to its relative value.

Well I do, but I guess it comes down to nuance in economics we tend to speak about economic stability or instability rather than economically stable.

Stable brings to mind structures and buildings.

I would have to say, I am not too much in agreement of the relative value of my dollars right now.

-

1

- Show all

Shifting Landscape Ahead: Why Gold Over Cash Makes Sense for Some Americans

https://www.breitbart.com/politics/...d-over-cash-makes-sense-for-some-americans-2/

And Genesis Gold Group’s solution to the uncertainty is gold. Here are 5 reasons why you should consider gold as your primary investment asset in 2024.

1. Gold Protects Against Inflation

In the last decade, inflation wasn’t just inevitable, it was created by government policy. And when the money supply goes out of control like this, you need a stable protector. Gold serves this role brilliantly. Its supply is out of any government’s hands and limited by its difficult mining process. As the purchasing power of the dollar has gone down, gold has gone up over the years.

2. Gold Shows Proven History of Growth

Not only does gold retain its value relative to the dollar, gold has shown consistent growth. While accounting for inflation, gold’s value has gone up over 210 percent in just the last 20 years. Plus, a stable growth trend can be seen going back centuries.

3. Gold Holds Intrinsic Value

It’s easy to trust gold. It’s tangible, durable, and its physical properties have many applications. Its value is dictated by a general demand that’s existed and grown since the dawn of humanity. On the flipside, the value of other assets, like cash or stocks, relies on dwindling trust in things you cannot control and can drop down to nothing.

4. Gold Provides a Safe Haven

When you don’t know what the future holds, gold is the safest foundation, especially in times of volatility, geopolitical tensions, and economical instability. Most savvy investors choose gold as a refuge in uncertain times due to its stability.

5. Gold Diversifies Effectively

Some of the most performant investment portfolios use gold as their backbone for stability. With its complex correlations, gold offers security at times when other assets fall short. Also, it stands in a category of its own, reacting independently to the market, making it a valuable tool for diversification.

For all these reasons and more, gold should hold a part of most portfolios. And if you wish to include gold in yours, it’s important to work together with a trusted company – not just any sketchy “Big Gold” company.

https://www.breitbart.com/politics/...d-over-cash-makes-sense-for-some-americans-2/

And Genesis Gold Group’s solution to the uncertainty is gold. Here are 5 reasons why you should consider gold as your primary investment asset in 2024.

1. Gold Protects Against Inflation

In the last decade, inflation wasn’t just inevitable, it was created by government policy. And when the money supply goes out of control like this, you need a stable protector. Gold serves this role brilliantly. Its supply is out of any government’s hands and limited by its difficult mining process. As the purchasing power of the dollar has gone down, gold has gone up over the years.

2. Gold Shows Proven History of Growth

Not only does gold retain its value relative to the dollar, gold has shown consistent growth. While accounting for inflation, gold’s value has gone up over 210 percent in just the last 20 years. Plus, a stable growth trend can be seen going back centuries.

3. Gold Holds Intrinsic Value

It’s easy to trust gold. It’s tangible, durable, and its physical properties have many applications. Its value is dictated by a general demand that’s existed and grown since the dawn of humanity. On the flipside, the value of other assets, like cash or stocks, relies on dwindling trust in things you cannot control and can drop down to nothing.

4. Gold Provides a Safe Haven

When you don’t know what the future holds, gold is the safest foundation, especially in times of volatility, geopolitical tensions, and economical instability. Most savvy investors choose gold as a refuge in uncertain times due to its stability.

5. Gold Diversifies Effectively

Some of the most performant investment portfolios use gold as their backbone for stability. With its complex correlations, gold offers security at times when other assets fall short. Also, it stands in a category of its own, reacting independently to the market, making it a valuable tool for diversification.

For all these reasons and more, gold should hold a part of most portfolios. And if you wish to include gold in yours, it’s important to work together with a trusted company – not just any sketchy “Big Gold” company.

Here is an article by a knowledgeable person telling us how foolish it was to resort to paper currency. Even as long ago as 1786 George Washington was fully aware of this folly.

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

https://www.infowars.com/posts/fixi...er-from-gold-standard-to-fiat-folly-and-back/

So was this FDR's blunder or something else, since he would have known what Washington said.

Fixing FDR’s Biggest Blunder: From Gold Standard to Fiat Folly and Back

https://www.infowars.com/posts/fixi...er-from-gold-standard-to-fiat-folly-and-back/

So was this FDR's blunder or something else, since he would have known what Washington said.

-

1

- Show all

if we stayed on the gold standard in currency, it would still have to be backed with gold. reasons fdr took us off the g.s. was to preserve actual gold in bullion form, collaterol, to make emergency purchases & also just to stockpile it.

if we stayed on the gold standard in currency, it would still have to be backed with gold. reasons fdr took us off the g.s. was to preserve actual gold in bullion form, collaterol, to make emergency purchases & also just to stockpile it.

What was the dollar value of the gold used in Solomon's temple? You will not believe this:

1. The OT talent was a measure of weight (unlike the NT talent)

2. David and the leaders of Israel provided a total of 108.000 talents, of which 3,000 talents was David's personal contribution and 5,000 talents came from the leaders (1 Chron 22:14; 29:3-7)

3. According to grandrapidscoins.com 1 OT talent weighed 75 pounds, and since there are 16 ounces in a pound, it weighed 1,200 ounces.

4. 108,000 talents would be equal to 108,000 x 1,200 = 129,600,000 ounces

5. The current price of gold per ounce is approx USD 2,344

6. So the total value of 108,000 talents = 129,600,000 x $2,344 = $303,782,400,000

7. That is three hundred three billion seven hundred eighty-two million four hundred thousand. Almost 400 billion dollars (at today's rate).

Christians should note that God gave David very specific instructions about the gold, silver, and brass to be used in Solomon's temple. And David (personally) as well as Israel's leaders gave gold willingly and joyfully for this project, which was given by God Himself. So there is a spiritual lesson here. David said that everything had come from God, so God was receiving what belonged to Him in the first place.

1. The OT talent was a measure of weight (unlike the NT talent)

2. David and the leaders of Israel provided a total of 108.000 talents, of which 3,000 talents was David's personal contribution and 5,000 talents came from the leaders (1 Chron 22:14; 29:3-7)

3. According to grandrapidscoins.com 1 OT talent weighed 75 pounds, and since there are 16 ounces in a pound, it weighed 1,200 ounces.

4. 108,000 talents would be equal to 108,000 x 1,200 = 129,600,000 ounces

5. The current price of gold per ounce is approx USD 2,344

6. So the total value of 108,000 talents = 129,600,000 x $2,344 = $303,782,400,000

7. That is three hundred three billion seven hundred eighty-two million four hundred thousand. Almost 400 billion dollars (at today's rate).

Christians should note that God gave David very specific instructions about the gold, silver, and brass to be used in Solomon's temple. And David (personally) as well as Israel's leaders gave gold willingly and joyfully for this project, which was given by God Himself. So there is a spiritual lesson here. David said that everything had come from God, so God was receiving what belonged to Him in the first place.

That was hardly sufficient reason to get off the gold standard. What would be the point of stockpiling it if it was not backing the currency? We are talking about a government, not a corporation or individual.

-

1

- Show all

Changing of currencies is disastrous to a population.

Every time it happens everyone suffers....the elderly suffer the most because their savings ALWAYS evaporate. They literally can't afford food and medicine anymore. Housing? Maybe if they outright own it and then only maybe because of taxes.

And a few "fat cats" always come out on top richer than ever before. Meanwhile everyone else starves. Changing back to a gold standard would do exactly that. Basically starve people to death.

Every time it happens everyone suffers....the elderly suffer the most because their savings ALWAYS evaporate. They literally can't afford food and medicine anymore. Housing? Maybe if they outright own it and then only maybe because of taxes.

And a few "fat cats" always come out on top richer than ever before. Meanwhile everyone else starves. Changing back to a gold standard would do exactly that. Basically starve people to death.

-

2

- Show all