Tax reform

- Thread starter RickyZ

- Start date

-

Christian Chat is a moderated online Christian community allowing Christians around the world to fellowship with each other in real time chat via webcam, voice, and text, with the Christian Chat app. You can also start or participate in a Bible-based discussion here in the Christian Chat Forums, where members can also share with each other their own videos, pictures, or favorite Christian music.

If you are a Christian and need encouragement and fellowship, we're here for you! If you are not a Christian but interested in knowing more about Jesus our Lord, you're also welcome! Want to know what the Bible says, and how you can apply it to your life? Join us!

To make new Christian friends now around the world, click here to join Christian Chat.

This is about TAXES. How did people in the United States fare under the new tax plan. Did you pay more or less?

Jatdq!

Jatdq!

-

1

- Show all

Probably broke even or paid a little less. I am quite sure that overall the tax cut benefitted the wealthy more the those who must get by on less. The tax plan did dramatically reduce the effective tax rate of various corporations that provide the jobs and the wages so it was not altogether a bad thing and the overall effect was positive for the economy in general.

-

1

- Show all

Another news story says in California, the majority are about breaking even, followed by those who are paying more, and then the smallest group are paying less.

Where's all the trump supporters? I would think they would be here in droves saying how their boy saved them money on their taxes. Are we to believe they did not save money?

Where's all the trump supporters? I would think they would be here in droves saying how their boy saved them money on their taxes. Are we to believe they did not save money?

I have to say I am very surprised by the lack of response here. I figure it has to be:

1. The completely erroneous thought that I lust after other people's money (which anyone who reads with the intent to hear and not to respond will know is wholly false); or

2. Trumpsters are ashamed to step up and say their boy cost them more taxes.

1. The completely erroneous thought that I lust after other people's money (which anyone who reads with the intent to hear and not to respond will know is wholly false); or

2. Trumpsters are ashamed to step up and say their boy cost them more taxes.

According to the news (which is always suspect), the majority of large corporations spent their savings on stock buybacks, not jobs and benefits.

Not to mention wages going up:

Initial Jobless Claims Tumble To Fresh 50 Year Lows

by Tyler Durden

Thu, 04/18/2019 - 08:39

68

SHARES

TwitterFacebookRedditEmailPrint

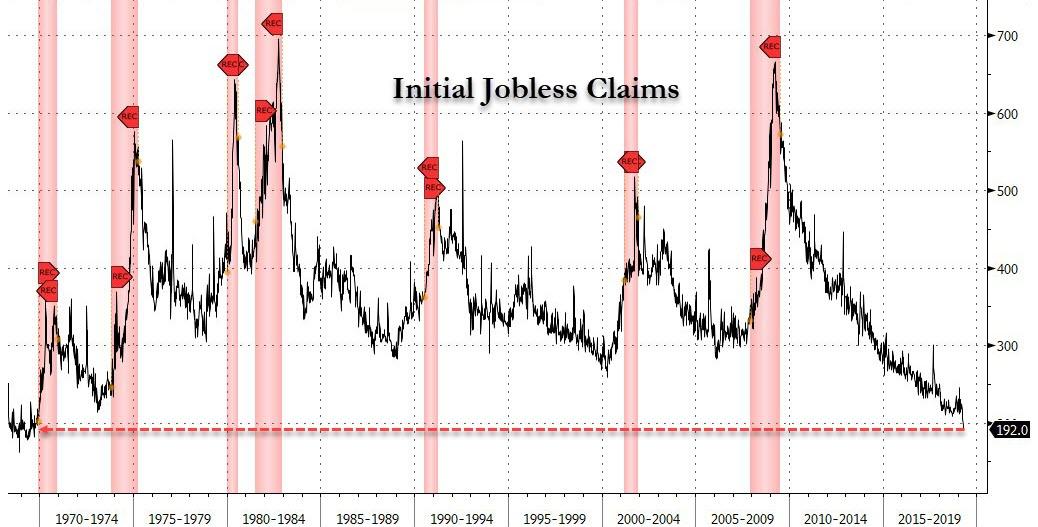

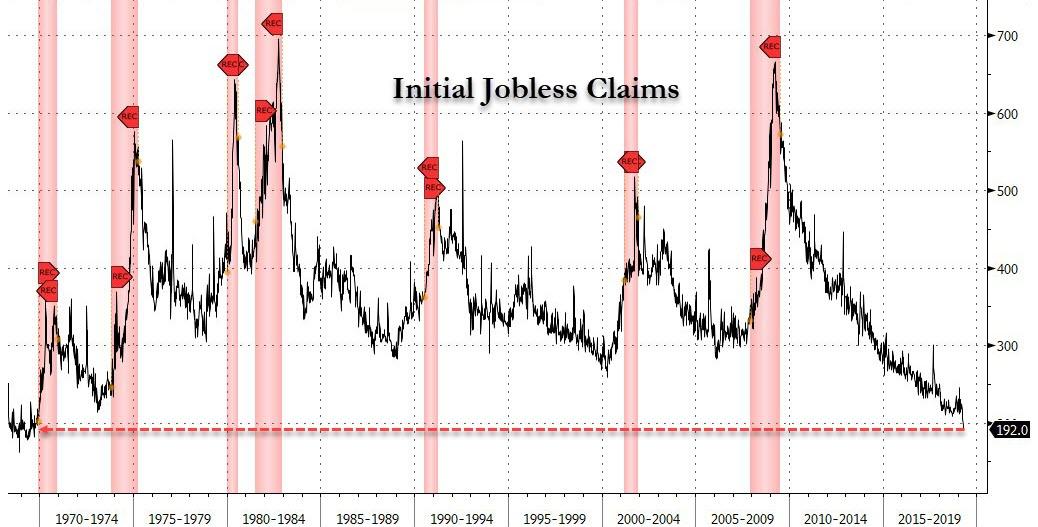

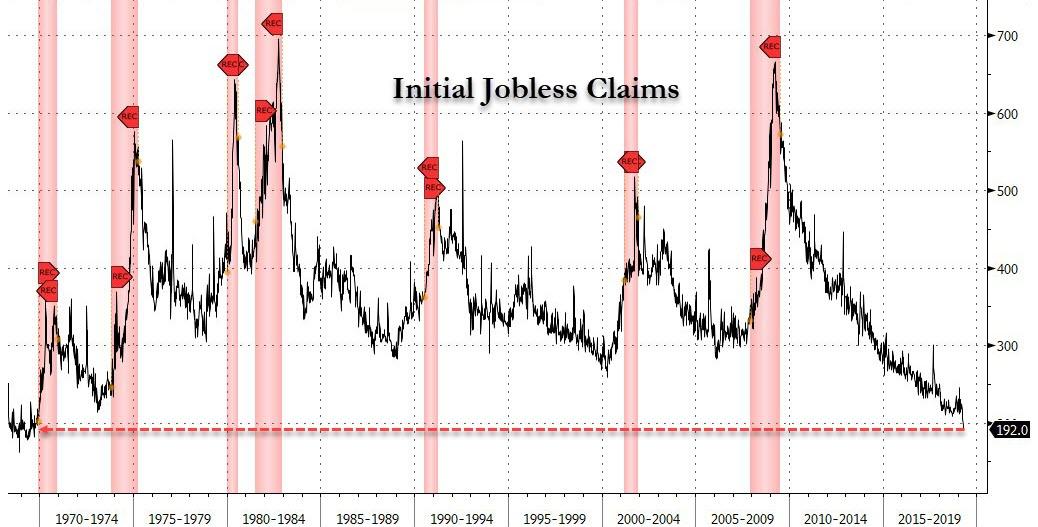

Initial jobless claims keep grinding lower and lower.

The last time this few Americans sought the help of government after losing a job was in November 1969. Initial Jobless Claims tumbled another 5K from the prior week's revised 197K to just 192K: the second consecutive sub-200K print in 50 years, and the lowest print since September 1969.

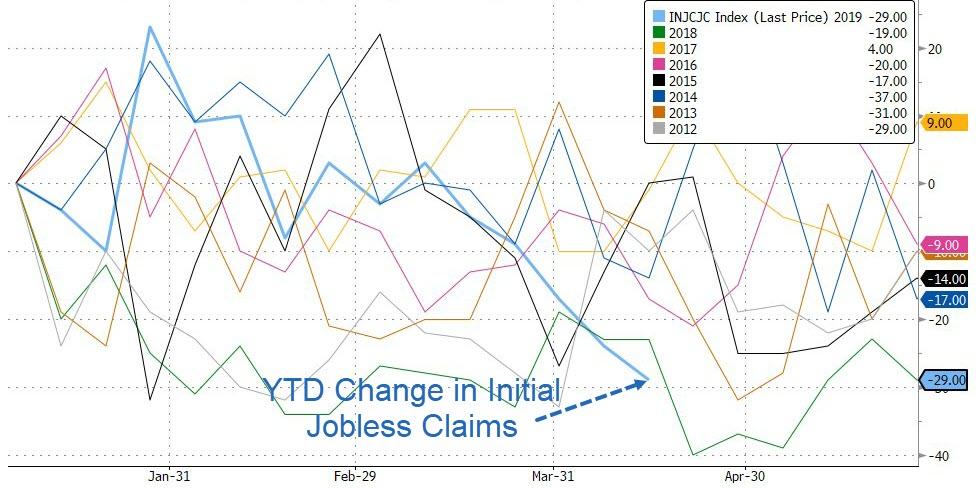

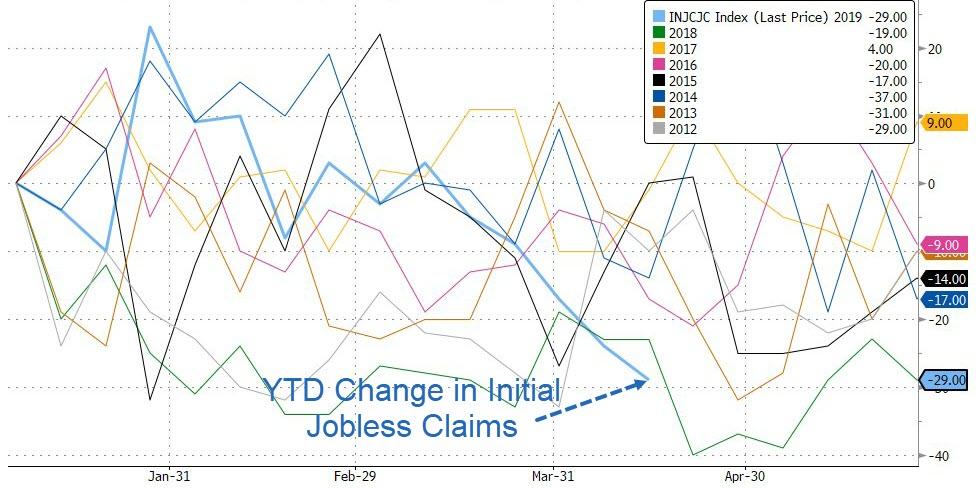

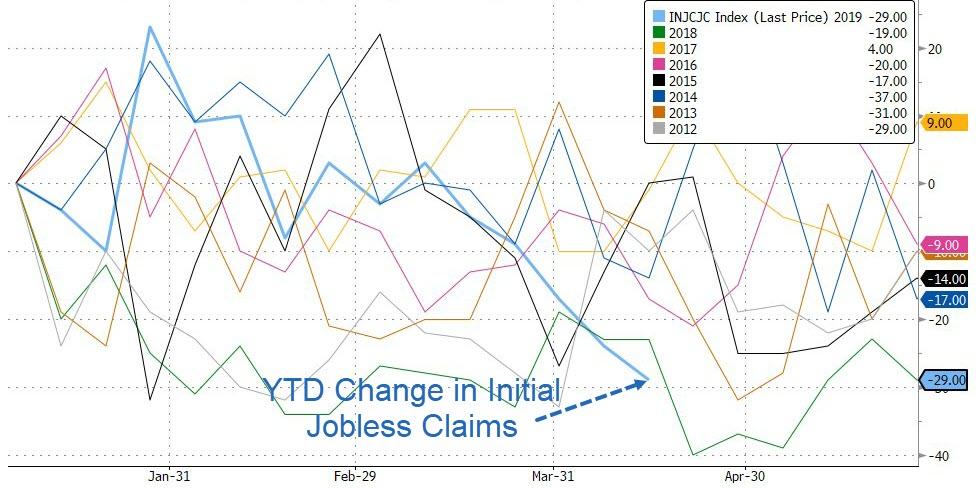

The YTD change in the absolute number of claims is now the best since at least 2011.

While the number will probably not come as a big surprise in light of the recent sharp rebound in payrolls, the Fed will be hard pressed to explain why it is pausing its rate hikes at a time when the fewest number of Americans are filing for jobless benefits in half a century.

For some context, the last time claims were this low:

- The Beatles' "Abbey Road" Album hit #1

- Wendy's Hamburgers, American fast food restaurant chains founded by Dave Thomas opens in Columbus, Ohio

- Alcatraz Island off SF, is seized by militant Native Americans

- US performs nuclear test at Nevada Test Site

- USSR performs nuclear test at Eastern Kazakh/Semipalitinsk USSR

Yeah!! They didn't provide any jobs at all! LOL

Not to mention wages going up:

Initial Jobless Claims Tumble To Fresh 50 Year Lows

by Tyler Durden

Thu, 04/18/2019 - 08:39

68

SHARES

TwitterFacebookRedditEmailPrint

Initial jobless claims keep grinding lower and lower.

The last time this few Americans sought the help of government after losing a job was in November 1969. Initial Jobless Claims tumbled another 5K from the prior week's revised 197K to just 192K: the second consecutive sub-200K print in 50 years, and the lowest print since September 1969.

The YTD change in the absolute number of claims is now the best since at least 2011.

While the number will probably not come as a big surprise in light of the recent sharp rebound in payrolls, the Fed will be hard pressed to explain why it is pausing its rate hikes at a time when the fewest number of Americans are filing for jobless benefits in half a century.

For some context, the last time claims were this low:

Not to mention wages going up:

Initial Jobless Claims Tumble To Fresh 50 Year Lows

by Tyler Durden

Thu, 04/18/2019 - 08:39

68

SHARES

TwitterFacebookRedditEmailPrint

Initial jobless claims keep grinding lower and lower.

The last time this few Americans sought the help of government after losing a job was in November 1969. Initial Jobless Claims tumbled another 5K from the prior week's revised 197K to just 192K: the second consecutive sub-200K print in 50 years, and the lowest print since September 1969.

The YTD change in the absolute number of claims is now the best since at least 2011.

While the number will probably not come as a big surprise in light of the recent sharp rebound in payrolls, the Fed will be hard pressed to explain why it is pausing its rate hikes at a time when the fewest number of Americans are filing for jobless benefits in half a century.

For some context, the last time claims were this low:

- The Beatles' "Abbey Road" Album hit #1

- Wendy's Hamburgers, American fast food restaurant chains founded by Dave Thomas opens in Columbus, Ohio

- Alcatraz Island off SF, is seized by militant Native Americans

- US performs nuclear test at Nevada Test Site

- USSR performs nuclear test at Eastern Kazakh/Semipalitinsk USSR

Like I said earlier, ours went up 800%. But to be honest I don't think we were paying our fare share before.

-

1

- Show all

I got substantially more than I ever have before "on paper". My student loan debt entered repayment without any sort of communication from the DOE so my entire return was offset. Technically I did far worse but not because of the new tax laws

I also had one of the seasonal jobs I worked at a few days into the new year (that was the cutoff point) I made $136 was claiming 1 and somehow I paid $10 in state tax and exactly .01 cents in federal taxes.

So I gave them a penny for my thoughts lol.

I also had one of the seasonal jobs I worked at a few days into the new year (that was the cutoff point) I made $136 was claiming 1 and somehow I paid $10 in state tax and exactly .01 cents in federal taxes.

So I gave them a penny for my thoughts lol.

-

1

- Show all

S

Now that's sad. But unfortunately all too common these days.

My income each year is just below the taxable amount.

I have no debt and live in an area that has a very low cost of living.

I have a reserve for unexpected cost.

If one can not live on $40,000 plus a year as a retired person, than that is very poor planning on their part.

-

1

- Show all

S

And that is encouraging to hear. I wish the statistic would exclude those who just stop looking. It's true that a growing labor shortage is leading to increasing pay and benefits too, which are waaay overdue. But the reports I'm seeing say most of the corporate bennies went to buybacks. But admittedly, I do get the LA times. Which is just as liberally biased as the conservative rags are conservative biased. LA Times/Dornsife poll last week reported the majority were the same or ahead a little bit as far as taxes go.

Like I said earlier, ours went up 800%. But to be honest I don't think we were paying our fare share before.

Like I said earlier, ours went up 800%. But to be honest I don't think we were paying our fare share before.

Maybe a higher tax bracket?

Not sad at all. Just the way I planned it.

My income each year is just below the taxable amount.

I have no debt and live in an area that has a very low cost of living.

I have a reserve for unexpected cost.

If one can not live on $40,000 plus a year as a retired person, than that is very poor planning on their part.

My income each year is just below the taxable amount.

I have no debt and live in an area that has a very low cost of living.

I have a reserve for unexpected cost.

If one can not live on $40,000 plus a year as a retired person, than that is very poor planning on their part.

But isn't that like cutting off your nose to spite your face?

there are many whose yearly income is below taxable income, not of pre-planning -

and they are living Biblically correct, by owing no man, and being good stewards'...

many years ago we both worked very hard at becoming 'debt-free', when we

reached our goal, it was one of the happiest days of our lives, and we are

still reaping this wonderful blessing,

Praise God...

PRO. 22:7.

The rich rules over the poor, and the borrower is servant to the lender.

and they are living Biblically correct, by owing no man, and being good stewards'...

many years ago we both worked very hard at becoming 'debt-free', when we

reached our goal, it was one of the happiest days of our lives, and we are

still reaping this wonderful blessing,

Praise God...

PRO. 22:7.

The rich rules over the poor, and the borrower is servant to the lender.

-

2

- Show all

there are many whose yearly income is below taxable income, not of pre-planning -

and they are living Biblically correct, by owing no man, and being good stewards'...

many years ago we both worked very hard at becoming 'debt-free', when we

reached our goal, it was one of the happiest days of our lives, and we are

still reaping this wonderful blessing,

Praise God...

PRO. 22:7.

The rich rules over the poor, and the borrower is servant to the lender.

and they are living Biblically correct, by owing no man, and being good stewards'...

many years ago we both worked very hard at becoming 'debt-free', when we

reached our goal, it was one of the happiest days of our lives, and we are

still reaping this wonderful blessing,

Praise God...

PRO. 22:7.

The rich rules over the poor, and the borrower is servant to the lender.

S

Wow. I was going to mention my older brother, who too plans to earn below the taxable amount since paying taxes violates his tea-party roots!

But isn't that like cutting off your nose to spite your face?

But isn't that like cutting off your nose to spite your face?

Since retiring, we have taken the standard deduction because that works best for us.

With the big increase in the standard deduction this year, we were able to increase our income and still pay no taxes.

Our only expenses are property tax and insurance and living in Arkansas that is less than $8000 a year.

If the day comes where I need more income, it is available. Planned it that way.

-

1

- Show all